Understanding the Legal Side of Vacation Rentals

The vacation rental industry has grown rapidly, fueled by platforms like Airbnb, Vrbo, and Booking.com. Property owners can now monetize their spaces by providing unique lodging experiences, while travelers enjoy access to distinctive accommodations around the world. However, the expansion of vacation rentals has also brought about a complex legal landscape that property owners must navigate. If you’re thinking of starting a vacation rental or already have one, understanding the legal requirements can help you stay compliant, avoid penalties, and protect your investment.

Here’s a comprehensive guide to the key legal aspects of vacation rentals, covering zoning laws, taxes, licenses, and guest agreements.

1. Zoning and Local Ordinances

Zoning regulations are among the first legal considerations when establishing a vacation rental. These laws, typically set at the local or municipal level, dictate how land can be used and what types of businesses can operate in specific areas. Some cities limit or restrict short-term rentals in residential areas, while others have designated zones where vacation rentals are allowed.

For instance, cities like Austin and New York City have strict regulations, often requiring special permits, occupancy limitations, or even outright bans on vacation rentals in certain neighborhoods. Before listing your property, check with your city or county’s zoning office to understand whether short-term rentals are permitted in your area.

Some resources for researching local zoning regulations include:

- Short-Term Rental Ordinance Resource Center by Airbnb

- National Association of Realtors’ Guide on Short-Term Rentals

2. Taxes and Fees

Short-term rentals are typically subject to a variety of taxes, including state and local sales taxes, hotel occupancy taxes, and, in some cases, value-added taxes (VAT) if the property is abroad. Failing to remit these taxes can result in fines, interest, or even criminal charges.

In the U.S., the two primary types of taxes that vacation rental owners may encounter are:

- Occupancy Taxes: Also known as lodging or transient taxes, these are often collected on stays of less than 30 days.

- Income Taxes: Profits from your vacation rental are considered taxable income by the IRS, so it’s essential to report earnings accurately and claim deductions as appropriate.

To simplify the tax process, platforms like Airbnb and Vrbo often collect and remit occupancy taxes on behalf of hosts in some locations. However, you may still need to register with local tax authorities and file any required returns. Resources like Avalara MyLodgeTax can also help with managing vacation rental taxes.

Learn more about tax requirements here:

3. Permits and Licenses

Many cities and counties require vacation rental owners to obtain specific licenses or permits. This could include a business license, a short-term rental permit, or both. Requirements vary widely; for instance, Los Angeles requires short-term rental hosts to register their properties, while Denver mandates a license for any primary residence listed for short-term stays.

Some locations may also impose restrictions on the number of guests allowed, the length of stays, and whether non-owner-occupied properties can be rented short-term. Failing to secure the appropriate permits can lead to fines or even property shutdowns. Always check with your local government to ensure compliance.

Helpful resources include:

4. Guest Agreements and House Rules

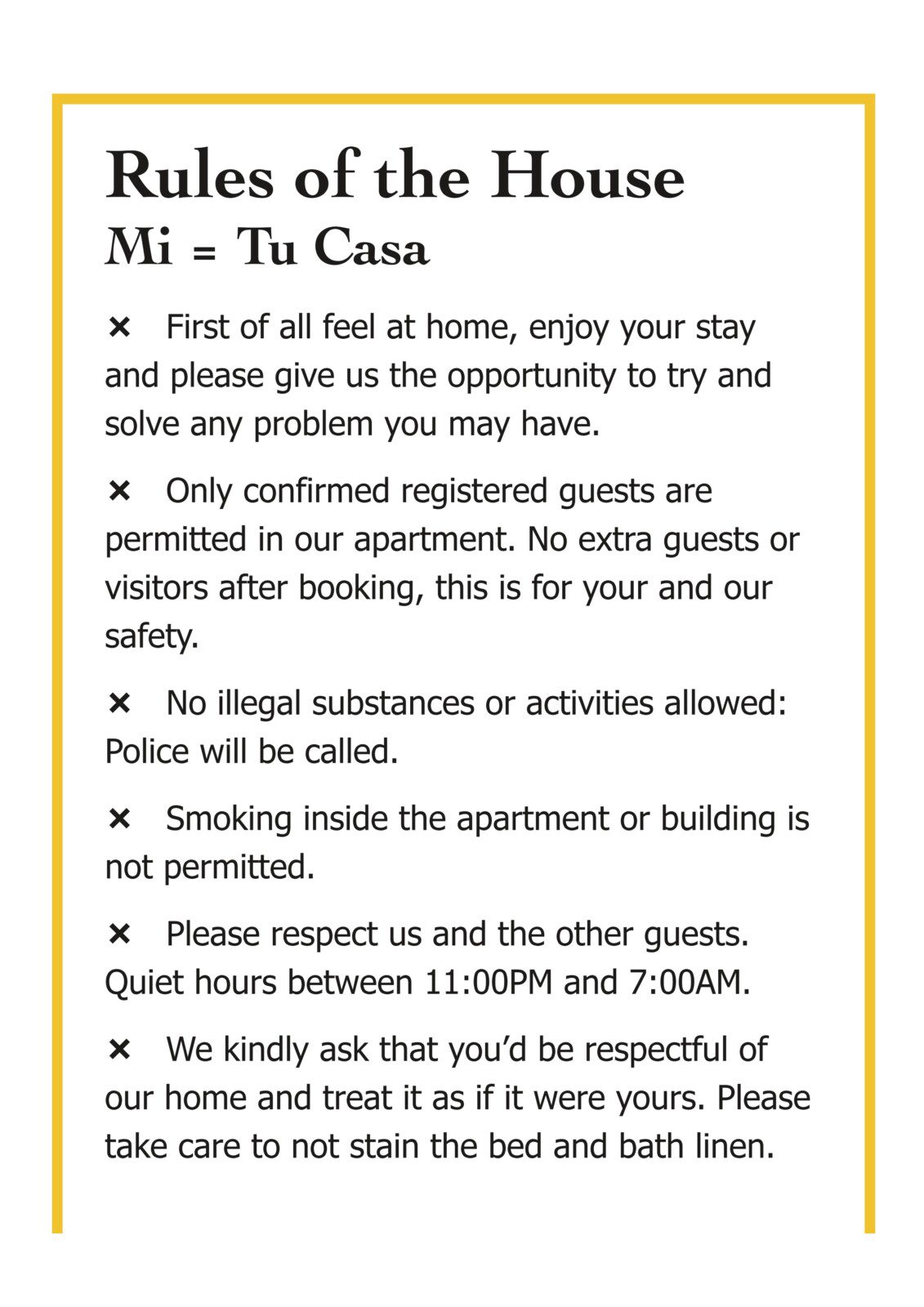

Having a clear guest agreement is essential to protect your property and avoid disputes. A well-written agreement should outline house rules, payment terms, liability waivers, and any damage policies. This document is especially important if you’re managing the property independently rather than through a platform like Airbnb, which provides a standardized set of terms for guests.

A comprehensive guest agreement should include:

- Check-In/Check-Out Times: Set clear policies to avoid confusion and streamline turnovers.

- Damage and Security Deposits: Detail how damages will be assessed and charged to the guest.

- Noise and Occupancy Limits: Define quiet hours and set limits on the number of occupants.

- Cancellation Policy: Specify conditions for refunds or penalties.

For a customizable guest agreement template, see:

5. Insurance Requirements

Standard homeowner’s insurance may not cover damages or liability incidents that occur during a rental stay. Investing in a dedicated short-term rental insurance policy can help protect against property damage, guest injuries, or even lawsuits. Some vacation rental platforms, like Airbnb, offer host protection insurance, but these may have limitations or exclusions.

Consider consulting with an insurance professional to determine the best coverage for your property and location.

For more information on vacation rental insurance:

Conclusion

The legal side of vacation rentals is complex but manageable. By understanding zoning laws, taxes, permits, and guest agreements, you can operate a compliant and profitable rental business. Familiarize yourself with local regulations and stay updated, as policies can change rapidly in response to the growing vacation rental market. With the right preparation and legal knowledge, you can focus on delivering a memorable experience to your guests while safeguarding your investment.

This guide is meant to provide a broad overview. For more specific legal advice, consult with a licensed attorney familiar with short-term rental laws in your area.

Maximize your rental income stress-free! We handle bookings, guest services, and maintenance for you. Let us manage your property—reach out today! CLICK HERE